Linear Models - Advanced Topics¶

We introduced how to use linear models for advanced analysis, e.g. causal effect.

Some types of data:

A cross-section of data is a sample drawn from a population at a single point in time

Repeated cross-sections are samples drawn from the same population at several points in time

If we have information on the same individuals at more than one point in time, we have panel data

Natural Experiments¶

A natural experiment is an empirical study in which individuals (or clusters of individuals) are exposed to the experimental and control conditions that are determined by nature or by other factors outside the control of the investigators. The process governing the exposures arguably resembles random assignment.

In short, two groups of similar individuals are exposed to different treatments. The assignment is determined by nature, which can be reasonably viewed as randomized.

We often use the “difference-in-differences” estimator to study repeated cross-sections or panel data when we have a natural experiment.

Difference-in-difference¶

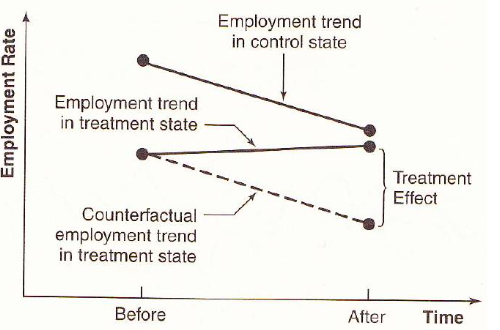

In DiD, we uses a control group to net out any trends over time.

Treatment |

Control |

|

|---|---|---|

Before |

\(A\) |

\(B\) |

After |

\(C\) |

\(D\) |

Difference |

\(C-A\) |

\(D-B\) |

Let \(\bar{y}_A, \bar{y}_B, \bar{y}_C, \bar{y}_D\) be the corresponding means of each group. DiD is computed as

Then we can conduct a two-sample \(t\)-test. We can also use regression with two categorial variables (After, Treat) and one interaction term.

where

\(\hat{\beta}_0 = \bar{y}_B\)

\(\hat{\beta}_2 = \bar{y}_A - \bar{y}_B\)

\(\hat{\beta}_3 = \bar{y}_D - \bar{y}_B\)

\(\hat{\beta}_1 = (\bar{y}_C - \bar{y}_A) - (\bar{y}_D - \bar{y}_B) = DiD\)

and we can test \(\hat{\beta}_1 = 0\).

To control other variables, we add them into the model (note about over controlling)

Fig. 65 Illustration of DiD model¶

Choice of Control Group¶

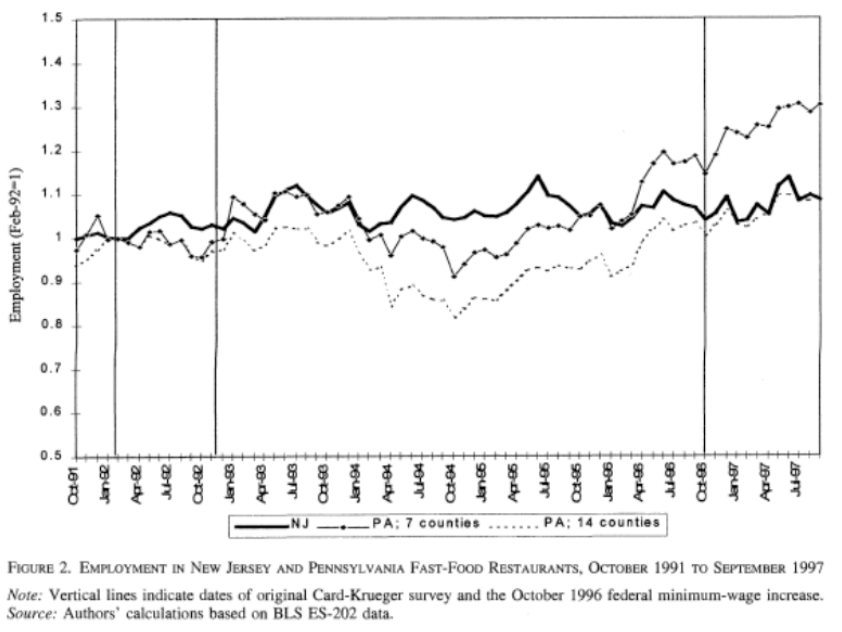

It is often hard to choose control group. One criteria is the common trends assumption.

- Assumption (Common trends):

In a before/after study, whatever factors change with time must affect the treatment and control group the same.

Use both theory and data to assess common trends

Theory: logical reasoning

e.g. Is this event/program a part of a broader set of programs?

Data: - plot \(y\) for the two groups along time before the treatment, see if they have similar ups and downs. - include fixed time effect, and test a year \(\times\) group interaction term.

If some unobserved factor changes more for treated group than for control, then we have bias.

Fig. 66 Check for parallel trend¶

A control group must enable you to approximate the counterfactual for the treated group – what would have happened to them if they had not received treatment?

For instance, in the project Taxes on the Rich (Feldstein (1995), Goolsbee (2000)). The tax policy impose a decrease in marginal tax rates for high income earners in 1986. Goolsbee examines increase in marginal rates in 1993 for high income earners. Lower (but still high) earners are control.

If common trends assumption met, can get unbiased estimate without balance.

Internal Validity¶

Internal validity refers to whether one can validly draw the inference that within the context of the study, to conclude that the differences in the dependent variables were caused by the differences in the relevant explanatory variables.

Some issues are

Omitted Variables: events, other than the experimental treatment, occurring between pre-intervention and post- intervention observations that provide alternative explanations for the results.

Trends in Outcomes: processes within the units of observation producing changes as a function of the passage of time per se, such as inflation, aging, and wage growth.

Misspecified Variances: omission of group error terms. Bertrand (2004) et al.

Mismeasurement: changes in definitions or survey methods that may produce changes in the measured variables. NHIS, CPS.

Political Economy: endogeneity of policy changes due to governmental responses to variables associated with past or expected future outcomes. Campbell and drunk driving.

Simultaneity: endogeneity of explanatory variables due to their joint determination with outcomes. Think price and quantity.

Selection: assignment of observations to treatment groups in a manner that leads to correlation between assignment and outcomes in the absence of treatment. Selection can take many forms. Trainees often do well relative to their recent past…

Attrition: the differential loss of respondents from treatment and comparison groups.

Omitted Interactions: differential trends in treatment and control groups or omitted variables that change in different ways for treatment and control groups. For example, a time trend in a treatment group that is not present in a comparison group. The exclusion of such interactions is a common identifying assumption in the designs of natural experiments. This is the common trends assumption.

Regression Discontinuity Design¶

Aka RDD.

Model¶

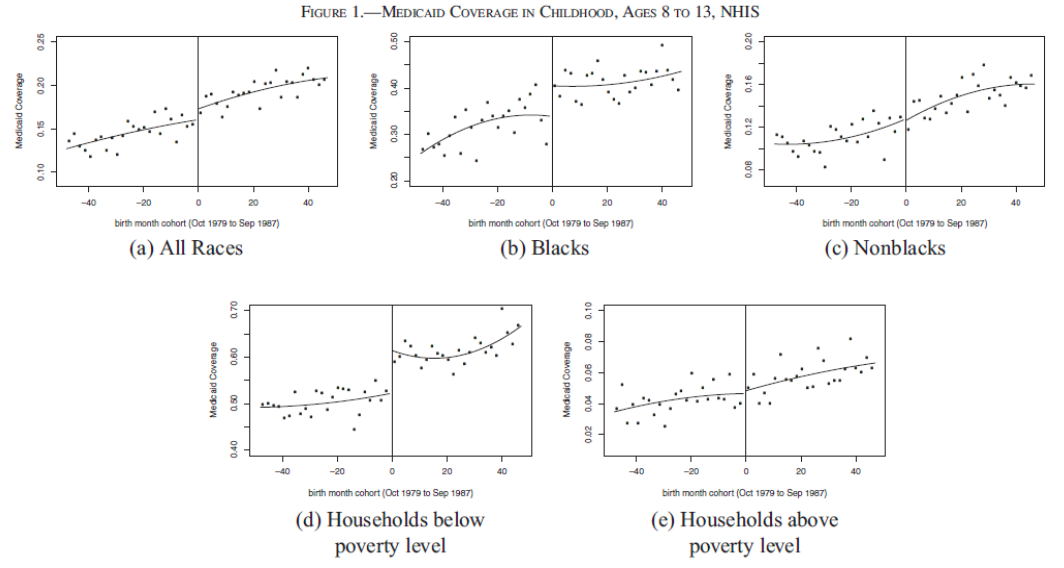

We want to analyze an policy effect to different group of people. For instance,

Effect of extended unemployment insurance benefits on willingness to work (measured by actual unemployment period), where the benefits are different for different age group, characterized by age cutoffs.

Effect of medicaid on health (measured by mortality or hospitalization rate), where the medicaid are different for different age group, characterized by birth date cutoffs

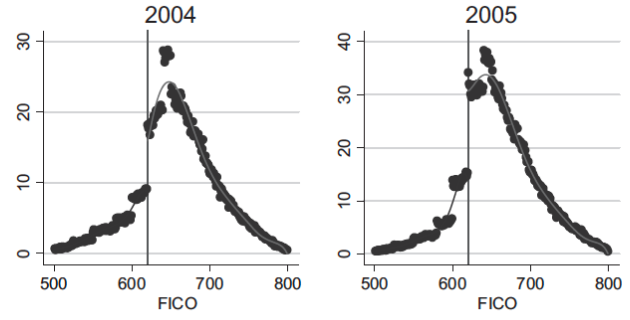

In loan application, a rule of thumb is that applicants with credit score greater than 620 have low delinquency probability and hence more likely to get accepted.

In sum, there is a sharp policy at cutoff point \(a^*\), while other characteristics that influence outcome (\(y\)) are very similar around \(a^*\). It should be as if we randomized and those just above \(a^*\) are the treatment group and just below a* are the control group. To analyze the policy effect at this cutoff, the regression discontinuity equation is

where

\(i\) is individual index

\(y_{i}\) is an outcome variable of interest (e.g. income, mortality rate) if different groups receive different treatments

\(a_i\) is so called running variable (e.g. age, score, time) which determines which treatment the individual receives

\(D_{a_i \ge a^*}\) is an indicator for an individual being above the cutoff \(a^*\)

\(f(a_i)\) is a function of \(a\), often linear or quadratic, and often with different slopes above and below \(a^*\)

The observations used to run this regression are those around \(a^*\), e.g. there is a bandwidth/window width

We can run this equation at each cutoff points in the policy

We are interested in \(\beta_1\).

Fig. 67 [Wherry and Meyer 2016]¶

Assumption¶

The observations are balance around the cutoff \(t^*\): they have very similar characteristics. To check this, we can replace \(Y\) by each characteristic over the above model, to see if \(\beta_1\) is significant.

Need to check the density around the cutoff to see if there is manipulation, e.g. strategic filing. If there is, exclude these observations that is close to cutoff \(t^*\).

Fig. 68 Loan Distribution by FICO: manipulation around 620.¶

Practical Issues¶

RD requires a large sample

Wider window (larger sample) increase precision as well as bias, precision vs. bias tradeoff. The window width can be a hyper parameter to test model robustness.

Can also try various functions \(f(t)\), often with polynomials with different parameters to the left and right of \(t^*\)

In some cases the cutoff is “hard” (unemployment benefit), and some times it is soft (credit score). If it is soft we call this fuzzy RD.

Instrumental Variables¶

Suppose we are in

Suppose the true model is

where \(X_2\) is unobservable. If we regress \(Y\) over \(X_1\), then we get a biased estimate for \(\beta_1\).

We can get a consistent estimate of \(\beta_1\) without controlling for \(X_2\) if we can find a valid instrument \(Z\) satisfying two conditions:

exogeneity condition (exclusion restriction): it is uncorrelated with \(u_i\)

relevance condition: it is correlated with \(X\)

We can view the relations as follows:

In short, \(Z\) represents the exogenous (not correlated with \(u\)) variation in \(X\). Variation in \(X\) caused by \(Z\) is not correlated with u. We use only this variation in \(X\) to estimate \(\hat{\beta}\).

But good instruments are hard to find. Exogeneity condition is often violated.

IV Estimator¶

Consider the covariance of instrument \(Z\) and response \(Y\):

Hence, \(\beta_1 = \frac{\operatorname{Cov}\left( Z,Y \right)}{\operatorname{Cov}\left( Z,X \right)}\). The IV estimator is

Properties

consistent, i.e. \(\operatorname{plim} \hat{\beta}_1^{\text{IV} } = \beta_1\).

asymptotic variance: \(\frac{\sigma^2 }{n \sigma^2 _x \rho_{x,z}^2}\)

Because the IV estimator uses only a subset of the variation in \(X\) to estimate the relationship between \(X\) and \(Y\), precision will fall (as compared to OLS).

If \(X\) and \(Z\) very weakly related, then small \(\rho_{x,z}^2\), precision will be very poor in the IV estimator.

But, if \(X\) and \(Z\) are too closely correlated, \(Z\) cannot be a good instrument because it will fail the exclusion restriction - if \(X\) and \(Z\) are perfectly correlated, then \(\operatorname{Cov}\left( Z, u \right)\) cannot be zero unless \(\operatorname{Cov}\left( X, u \right)\) is also zero (which means we don’t need an instrument in the first place).

Two-Stage Least Squares¶

Aka 2SLS.

To accommodate many \(X\)’s and \(Z\)’s, we use two-stage least squares. Suppose the model is

where

\(X_1, \ldots, X_k\) are endogenous (possibly correlated with \(u\))

\(W_1, \ldots, W_r\) are exogenous (not correlated with \(u\))

\(Z_1, \ldots, Z_m\) are instruments

\(m \ge k\): more instruments than endogenous regressors.

Steps:

For each \(X_j\), regress \(X_j\) on all \(Z\) and all \(W\), compute predicted values \(\hat{X}_j\).

Regress \(Y\) on all predictions \(\hat{X}_j\) and all \(W\). The resulting \(\hat{\beta}\) are the 2SLS estimates of \(\beta\).

Assumptions

\(\mathbb{E}\left( u_i \mid W_1, \ldots, W_r \right)=0\)

Finite kurtosis for all \(X,W,Z\) and \(Y\)

\(\hat{X}\)’s and \(W\)’s are not perfect multicollinear

Exogeneity: \(\operatorname{Cov}\left( Z_j, u \right)=0\) for all \(j\)

not testable

fail if \(Z\) is related to some other factor that influences \(Y\), or \(Z\) has a direct effect on \(Y\).

Relevance: \(\operatorname{Cov}\left( Z, X \right) \ne 0\)

testable: \(F\)-test on instruments in first stage larger than 10.

if fail, then inconsistent, bias, no-normal.

Note

\(R^2, F\)-test are invalid

Interpretation¶

\(\beta^{2SLS} = \mathbb{E}\left( \beta_i \right)\) is a local average treatment effect (LATE). If \(\beta_i = \beta\) for all \(i\), then \(\beta^{2SLS} = \beta\).

Simultaneity¶

If \(X\) causes \(Y\) and \(Y\) causes \(X\) (reverse causality), we say there is simultaneity. For instance, price and demand.

Consider the simultaneous equations below. If \(\gamma_1 \ne 0\), then \(u_i\) affects \(Y_i\) in \((1)\) and then \(Y_i\) affects \(X_i\) in \((2)\), i.e. \(X_i\) and \(u_i\) are correlated.

Simultaneity is a specific type of endogeneity problem in which the explanatory variable is jointly determined with the dependent variable. As with other types of endogeneity, Instrumental Variables (IV) estimation can sometimes solve the problem. There are special issues to consider with a simultaneous equations model (SEM).

Example¶

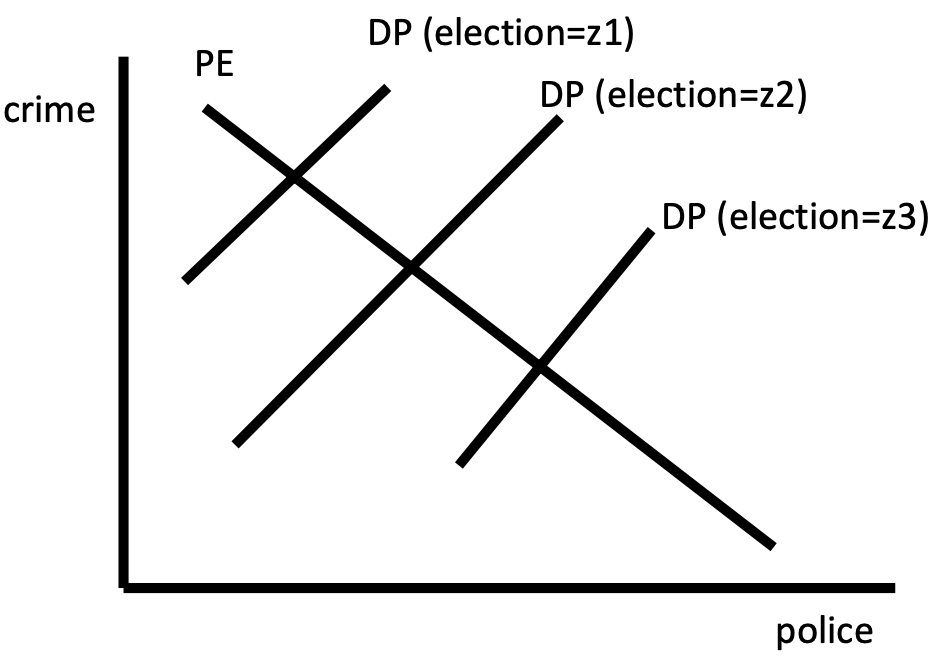

Start with an equation we like to estimate: regress crimes per capita on police per capita. Call this a structural equation. Clearly, it has a causal interpretation.

However, the need for police is also determined by the level of crime. Both variables are endogenous because both are determined by the equilibrium process.

Consider a second structural equation, where \(\text{election}\) is the time until the next election.

This equation captures that elected officials respond to crime levels (such as the influence of police unions, and the importance of perceptions of effectiveness). The variable \(\text{election}\) is exogenous. We can then consider using \(\text{election}\) as an instrument for \(\text{police}\).

Fig. 69 Equilibrium [Meyer 2021]¶

To obtain a consistent estimator of \(\alpha_1\), use 2SLS

regress \(\text{police}\) over \(\text{election}\)

regress \(\text{crime}\) over the predicted value \(\widehat{\text{police} }\)

But we cannot estimate \(\beta_1\).

Panel Data¶

Recall the common trends assumption. Can we generalize it? What if there are more than 2 periods and more than 2 groups? We introduce first difference and fixed effect, for more than s.

Panel data, aka. longitudinal data, are data constructed from repeated samples of the same entities/individuals \(i\) at different points \(t\) in time.

where entities \(i=1, \ldots, N\) and time \(t=1, \ldots T\), if balanced. There can also be unbalanced panel data such that the total number of observations is less than \(NT\).

For instance,

Graduation rate at each school in Chicago over last 10 years

Poverty rate for each state over several years

Earnings of workers over time before and after disability

Note

Panel data is different from repeated cross-section data that have multiple observations per sample in multiple time periods.

Whether an analysis uses repeated cross-section or panel data sometimes depends on how raw data are manipulated. Consider a random sample of 100 people from each state, taken every year.

Different people each year – so it is repeated cross-section if \(i\) indexes people

If the individuals from a state are aggregated into a state average, then since we have the same states year after year it is panel — now \(i\) indexes states

Panel data enable us to remove bias from certain types of omitted variables.

If omitted variables for entity \(i\) do not change over time,

Or if omitted variables for time period \(t\) do not differ across entity,

Then panel data gives unbiased estimates.

First Difference¶

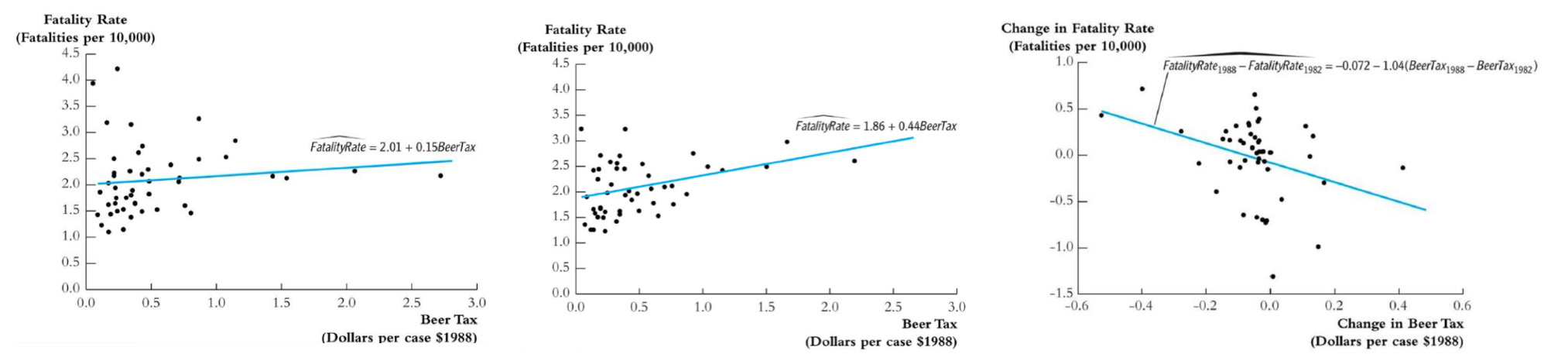

Suppose we have a panel data set at two time points \(t_1\) and \(t_2\). Suppose the true model is

where \(\mathbb{E}(u_{it} \vert X_{1it}, X_{2it})=0\). But we only observe \(X_{1}\) and omit \(X_2\). Then running a regression model \(Y_i \sim X_{1i}\) at each time point leads to a biased estimate of \(\beta_1\). However, the difference is

If \(\Delta X_{2i}=0\) for each \(i\), i.e., for \(X_{2it}\) does not change over time \(t\) for entity \(i\), then we can run regression \(\Delta Y_i \sim \Delta X_{1i}\) (include intercept) and obtain an unbiased estimate of \(\beta_1\). The intercept estimate \(\tilde{\beta}_0\) can be interpreted as the change of \(\beta_0\) over time.

Fig. 70 Regression using 1982 data, 1988 data, and first difference method [Wooldridge]¶

For \(T > 2\) case, we can run compute \(\Delta Y_{it} = Y_{i(t+1)} - Y_{it}\) and \(\Delta X_{1it}\), for each \(t=1,\ldots, T-1\), and use all these \((T-1)n\) number of \((\Delta Y, \Delta X)\) pairs to run a regression to obtain \(\hat{\beta}_1\).

Rationales of FD

FD regress the change in \(Y\) against the change in \(X\)

If omitted variables are constant over time (time invariant), then they will be unrelated to changes in \(Y\) and \(X\) for a given \(i\).

Differencing gets rid of time invariant unobservables, as well as time invariant observables.

Pros

If OLS on the cross-sectional data is biased by time invariant omitted variables, then FD can solve this problem.

Cons

Cannot solve bias caused by time varying variables, if they are correlated with \(\Delta X\). It’s like we omit \(\Delta X_{2i} \ne 0\) in \(\Delta Y_{i} = \beta_1 \Delta X_{1i} + \beta_2 \Delta X_{2i} + \Delta u_{i}\)

Cannot estimate coefficient for time invariant variables (\(\beta_2\) in the above case)

Lower variation in independent variable sine \(\sigma_{\Delta X}^{2} \ll \sigma_{X}^{2}\). Higher standard error of estimate

May exaggerate measurement error since signal is reduced but noise variance is larger.

Fixed Effect¶

Entity Fixed Effect¶

In FD we drop time invariant variable \(\beta_2 X_{2it} = \beta_2 X_{2i}\) to estimate \(\beta_1\), but in fixed effect model we estimate these \(\beta_2 X_{2i}\). Suppose again the true model is

If \(X_{2it}\) is time invariant, then we can write

which suggests that each entity \(i\) has a different intercept \(\alpha_i\). Hence, the new equation can be estimated by letting each entity \(i\) have a unique intercept. This is called fixed effects regression.

where \(d_i\) is a dummy variable indicating if an observation is in group \(i\). The total number of observations in this regression is \(NT\), and number of parameters is \(N+1\).

Note that

If \(T=2\) then FD=FE.

If there is autocorrelation of errors within an entity, use clustered standard error.

Precision of \(a_i\) depends on the number of observations in entity \(i\).

Equivalent to de-mean regression: compute entity means for both \(X\) and \(Y\), subtract them from \(X\) and \(Y\), and run regression to obtain \(\hat{\beta}_1\).

Time Fixed Effect¶

Some omitted variables very over time but are the same across entities within a time period.

Examples:

Federal policy may affect all states the same

Macroeconomic shocks may affect many workers the same

Technological change may affect all firms the same

Quarterly seasonal effect

Fall/summer effect for agricultural data

The total number of observations in this regression is \(NT\), and number of parameters is \(T+1\).

Both¶

We can include both entity and time fixed effect. This will eliminate both time invariant unobservables within each entity \(\alpha_i\), and entity invariant unobservables within each time period \(\alpha^t\).

The total number of observations in this regression is \(NT\), and number of parameters is \(N + T+1\).

Example:

Drinking culture fixed within states (\(a_i\))

Federal policy changes affect all states the same (\(a^t\))

Pros

Can eliminate bias due to time invariant unobservable factors or entity invariant unobservable factors.

Cons

Time varying unobservables that are unique to each state (not a common shock) can still cause bias.

Cannot study the effect of things that do not vary over time or within entity.

Time Series¶

Time series data are data that are temporally ordered.

Two variables \(Y_t\) and \(X_t\) could be related contemporaneously:

\(X_t\) affect \(Y_t\), e.g. corn price and bacon price

dynamic: \(Y_{t-1}\) affects \(X_t\), and \(X_t\) affects \(Y_t\), e.g. oil price and fuel demand

\(\hat{Y}_{t+1}\) affects decision at \(t\).

Static and dynamic models:

If no lagged \(Y\) and only contemporaneous \(X\), model is static $\(Y_{t}=\beta_{0}+\beta_{1} X_{t-1}+\beta_{2} X_{t-2}+\cdots+u_{t}\)$

Otherwise, if both affect \(Y\), we call it dynamic $\(Y_{t}=\beta_{0}+\beta_{1} Y_{t-1}+\beta_{2} X_{t}+\beta_{3} X_{t-1}+u_{t}\)$

Note that the explanatory variables are no longer fixed. For instance, \(Y_{t-1}\) contains a random component \(u_{t-1}\).

Autoregression¶

Consider a simple autoregression model

Recall the OLS estimator for \(\beta_1\) is

The bias term is

This is not simply zero, since the terms in the denominator \(y_{\ge s}\) depends on \(u_s\). Hence, \(\hat{\beta}_1\) is not an unbiased estimator in general.

If serial correlation exists: \(u_{t}\) and \(u_{t-1}\) are correlated, the regressor \(Y_{t-1}\) which contains \(u_{t-1}\) is now correlated with \(u_t\). This leads to biased \(\beta_1\). It is also inconsistent. But we can use \(y_{t-2}\) as an instrument for \(y_{t-1}\) to obtain consistent estimate, if \(u_{t-2}\) is not correlated \(u_{t}\).

Spurious Correlation¶

When time series data have trends over time, they will frequently be strongly spuriously correlated with each other. You can think of the time trend as an omitted variable that causes omitted variables bias.

More Concepts¶

Trends: steadily rising or falling in \(t\). To account for this, we can add a term \(\beta(t-t_0)\) into the model, there \(t_0\) is the start year. We can also use first difference.

Breaks: relationship between \(X\) and \(Y\) changes at some period. To account for this, we can add \(\beta d_{t \le t^*}\) and \(\beta d_{t > t^*}\) where \(d\) is a dummy variable.

Interpretation: Consider a dynamic model

\[Y_t = \beta_0 + \beta_1 Y_{t-1} + \beta_2 X_t + \beta_3 X_{t-1} + u_t\]What is the effect of one unit change in \(X_{t-1}\) on \(Y_t\)? It is not simply \(\beta_3\) since \(X_{t-1}\) also affects \(Y_{t-1}\). The answer should be \(\beta_2 \beta_1 + \beta_3\).

Forecasting error: root mean squared forecast error, where \(\hat{Y}_{t+1 \mid t}\) means using data available up to \(t\) to predict \(Y\) at \(t+1\).

\[R M S F E=\sqrt{E\left[\left(Y_{t+1}-\hat{Y}_{t+1 \mid t}\right)^{2}\right]}\]

Categorical Data¶

TBD.

dummy variables \(X_{ij}\)

when \(c = 2\),

interpretation

\(\hat{\beta}_1\): difference in means between the group with \(X=1\) and \(X=0\).

\(\hat{\beta}_0\): mean of the group with \(X=0\).